Investments are dynamic, everchanging, and complex. Anyone considering a long-term career in investing knows they have to start somewhere. At Quantum Lumina V5, we encourage that the first step is getting an education. Education goes a long way in any endeavor. People looking to become seasoned must ground themselves with knowledge.

Quantum Lumina V5 connects individuals looking to learn how to invest to suitable firms where they can learn. Quantum Lumina V5 does not teach people how to invest. However, we truly understand the role education plays in investing and how exhausting it can be to find a suitable education firm tailored to specific learning needs.

We are a gateway connecting willing learners to appropriate education firms. In basic investment education, individuals learn key concepts like risk assessment, portfolio diversification, investment strategies, and the tools they need to make informed financial choices. Register on Quantum Lumina V5 for free.

When starting the journey of investing, finding a suitable tutor who can understand and teach the concepts thoroughly should be the first step. But most beginners delve into investing immediately and face the consequences of their actions in real time. Quantum Lumina V5 encourages users to take an education-first approach to investing.

Not new to investing but need to up the juice? Quantum Lumina V5 is the bridge connecting users at all levels to education firms catering to their learning needs.

Advanced investment courses offer insights into complex financial instruments, advanced trading strategies, risk management techniques, and in-depth analysis methods.

Many people think finding a suitable investment education firm will cost them a fortune, and in most cases, they would be right. But with Quantum Lumina V5, they aren’t.

Quantum Lumina V5 connects individuals to education firms that align with their specific budgets. No one has to break the bank to learn investments.

Registration on Quantum Lumina V5 is free and straightforward. It takes less than two minutes and only requires an individual’s name, email address, and phone number.

Users are matched with a firm immediately after signing up. This firm is tailored to meet their learning needs, and they can go at their own pace.

After matching, users are assigned a representative of the matched firm who will put them through any hurdles they may have. Learning may begin immediately after that.

Many people are interested in investing but don’t know where to start. Others may know they need an education but can not find one to cater to their learning needs. Quantum Lumina V5 removes such barriers by linking individuals directly to tutors who can teach users what they need to make informed decisions.

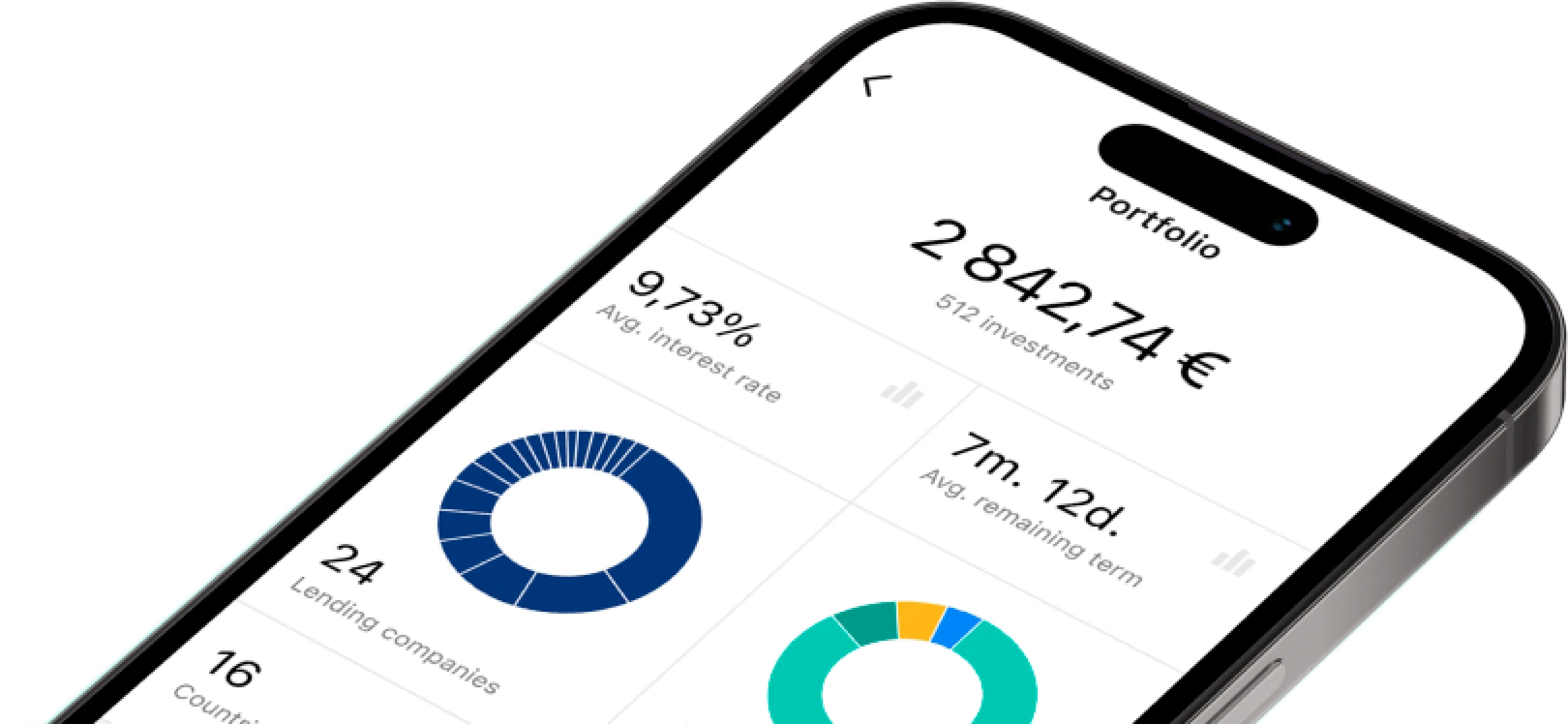

Quantum Lumina V5 connects people to investment education firms that equip individuals with fundamental financial concepts, risk assessment skills, and investment strategies. Users can learn to analyze market trends, evaluate asset classes, and construct diversified portfolios to make informed financial choices and pursue their objectives.

Quantum Lumina V5 is committed to inclusivity. We link users to tutors that offer investment education resources tailored to individuals from diverse backgrounds and linguistic preferences. Quantum Lumina V5 is available in multiple languages, ensuring accessibility and helping users worldwide learn about investing and make informed financial decisions.

Quantum Lumina V5 embraces diversity. We are the bridge where individuals from all walks of life can access investment education tailored to their unique needs. Quantum Lumina V5 celebrates diversity of thought, culture, and experience. We recognize the value of diverse perspectives in enriching the learning journey and fostering financial literacy.

At Quantum Lumina V5, connecting with suitable investment education resources is free. We value individual time and provide a seamless registration process that takes less than two minutes. It only requires users to enter their name, email address, and phone number. Quantum Lumina V5 is committed to accessibility, ensuring individuals can start their investment education journey without financial barriers.

The Investment World is Wide

Investments cover a wide range, and risk cuts across every level of investing.

Navigation is Surely Difficult

Anyone who goes into investments without understanding the landscape may find it daunting.

Education Inspires Informed Decision Making

Guidance through complexities aids in making informed investment choices.

Investment education for beginners covers foundational concepts like asset classes, risk assessment, and basic investment strategies. Understanding these fundamentals forms the building blocks for navigating the investment landscape and making informed financial decisions. Learn the basics with Quantum Lumina V5; sign up for free.

At Quantum Lumina V5, our priority is education. We are dedicated to connecting as many as willing to learn to firms that provide comprehensive investment education resources to help individuals make informed financial decisions. Quantum Lumina V5 prioritizes learning, equipping users with the knowledge and tools they need to navigate the complexities of the investment landscape.

Investment basics are foundational principles that form the cornerstone of any investment journey. They encompass fundamental concepts such as asset classes, risk and return, diversification, and the importance of time in investing. These basics can give individuals a solid framework for making informed investment decisions.

Asset classes are the building blocks of an investment portfolio and include stocks, bonds, cash equivalents, and alternative investments. Each asset class carries its own risk and return characteristics, and understanding their differences is essential for constructing a diversified portfolio that may balance risk and return according to an individual's investment objectives and risk tolerance. Quantum Lumina V5 encourages users to learn the basics before they invest.

Risk and return are inherently linked in investing, with higher returns typically associated with higher levels of risk. Diversification, or spreading investments across different asset classes and securities, may help mitigate risk by reducing the impact of any single investment's performance on the overall portfolio.

Investment strategies are systematic approaches investors employ to pursue financial goals while managing risk. These strategies encompass various methodologies, including value investing, growth investing, income investing, and momentum investing, each emphasizing different criteria and techniques for selecting investments. Sign up on Quantum Lumina V5 for free to start the learning process.

Informed investment strategies are tailored to an individual's financial objectives, risk tolerance, and time horizon. They often involve thorough research, analysis of market trends, and disciplined execution. By implementing a defined investment strategy, investors can pursue long-term financial goals.

Value investing involves identifying securities perceived to be undervalued, trading below their intrinsic value, typically in the stock market. Investors seek out companies with strong fundamentals but are currently trading at a discount relative to their perceived intrinsic worth. While value investing can offer significant returns, it may be susceptible to market volatility and prolonged periods of underperformance.

Growth investing focuses on companies that may demonstrate significant earnings or revenue growth, often found in industries experiencing rapid expansion, such as technology or biotechnology. This strategy targets stocks and may offer high returns but carries the risk of overvaluation and heightened volatility, particularly during market downturns.

Income investing prioritizes investments that may yield regular income streams, such as dividend-paying stocks, bonds, or real estate investment trusts (REITs). This strategy is commonly associated with fixed-income securities. It aims to provide a steady cash flow stream, making it less susceptible to market fluctuations but susceptible to interest rate and credit risk.

Momentum investing involves selecting assets with positive price trends and investing in them with the expectation that the trend will continue in the short to medium term. This strategy is commonly applied to stocks but can also be used for other asset classes. While momentum investing can lead to significant gains, it is susceptible to abrupt reversals and market corrections.

Financial metrics are quantitative measures used to assess the performance, health, and efficiency of a company or investment. These metrics encompass various indicators, including liquidity and efficiency ratios, providing insights into various aspects of an organization's financial performance.

By analyzing financial metrics, stock investors can evaluate a company's liquidity position, debt levels, and operational efficiency, aiding investment decision-making and risk assessment. Common financial metrics include earnings per share (EPS), return on equity (ROE), debt-to-equity ratio, and current ratio, offering unique insights into a company's financial health and performance.

The financial landscape encompasses a vast array of markets, instruments, and institutions that facilitate the flow of capital. It includes stock markets, bond markets, commodities markets, banking institutions, and regulatory bodies, shaping the global economy and influencing investment decisions.

Understanding the financial landscape requires knowledge of economic principles, market dynamics, and regulatory frameworks. Investors navigate this landscape by analyzing macroeconomic indicators, geopolitical events, and industry trends to identify possible opportunities and manage risks.

The financial landscape is dynamic and constantly evolving, driven by technological advancements, globalization, and shifting consumer preferences. Staying abreast of emerging trends, regulatory changes, and geopolitical developments is essential for investors to adapt their strategies in a rapidly changing financial environment.

An asset is any resource with economic value that an individual, company, or entity owns or controls. Assets can include tangible items like real estate, equipment, and inventory, as well as intangible assets such as patents, copyrights, trademarks, and financial instruments like stocks and bonds.

Tangible assets are physical assets with a distinct value and include real estate, vehicles, machinery, equipment, and inventory.

Intangible assets, such as patents, copyrights, trademarks, brand recognition, and goodwill, lack physical substance but may hold significant value.

Financial assets represent ownership of a contractual claim to possible future cash flows or capital appreciation, including stocks, bonds, mutual funds, and derivatives.

Liquid assets are easily convertible to cash without significant loss of value, such as cash, savings accounts, certificates of deposit (CDs), and money market instruments.

Fixed assets are long-term assets for producing or providing goods and services, including land, buildings, machinery, and infrastructure.

Current assets are expected to be converted into cash or consumed within one year, including cash, accounts receivable, inventory, and short-term investments.

Anyone who wishes to play a game for a long time must first understand its rules. Otherwise, they just roam clueless. Investments, though more serious than a game, are just like that. Without a comprehensive education as a guide, many people tend to make investments based on hearsay and intuition. Start the journey with education. That way, one can make informed choices.

| 🤖 Entry Fee | No entrance fee |

| 💰 Incurred Costs | Free of any charges |

| 📋 Process of Joining | Registration is streamlined and fast |

| 📊 Subjects Covered | Education on Crypto assets, Forex markets, and Investment strategies |

| 🌎 Eligible Countries | Almost all countries are supported except the US |